Property division ranks among the most complex aspects of divorce proceedings in Florida. Without proper preparation, couples often overlook valuable assets or make costly mistakes that impact their financial future.

We at Christine Sue Cook, LLC have seen how a comprehensive divorce property division checklist transforms this overwhelming process into manageable steps. This guide walks you through creating your own checklist to protect your interests.

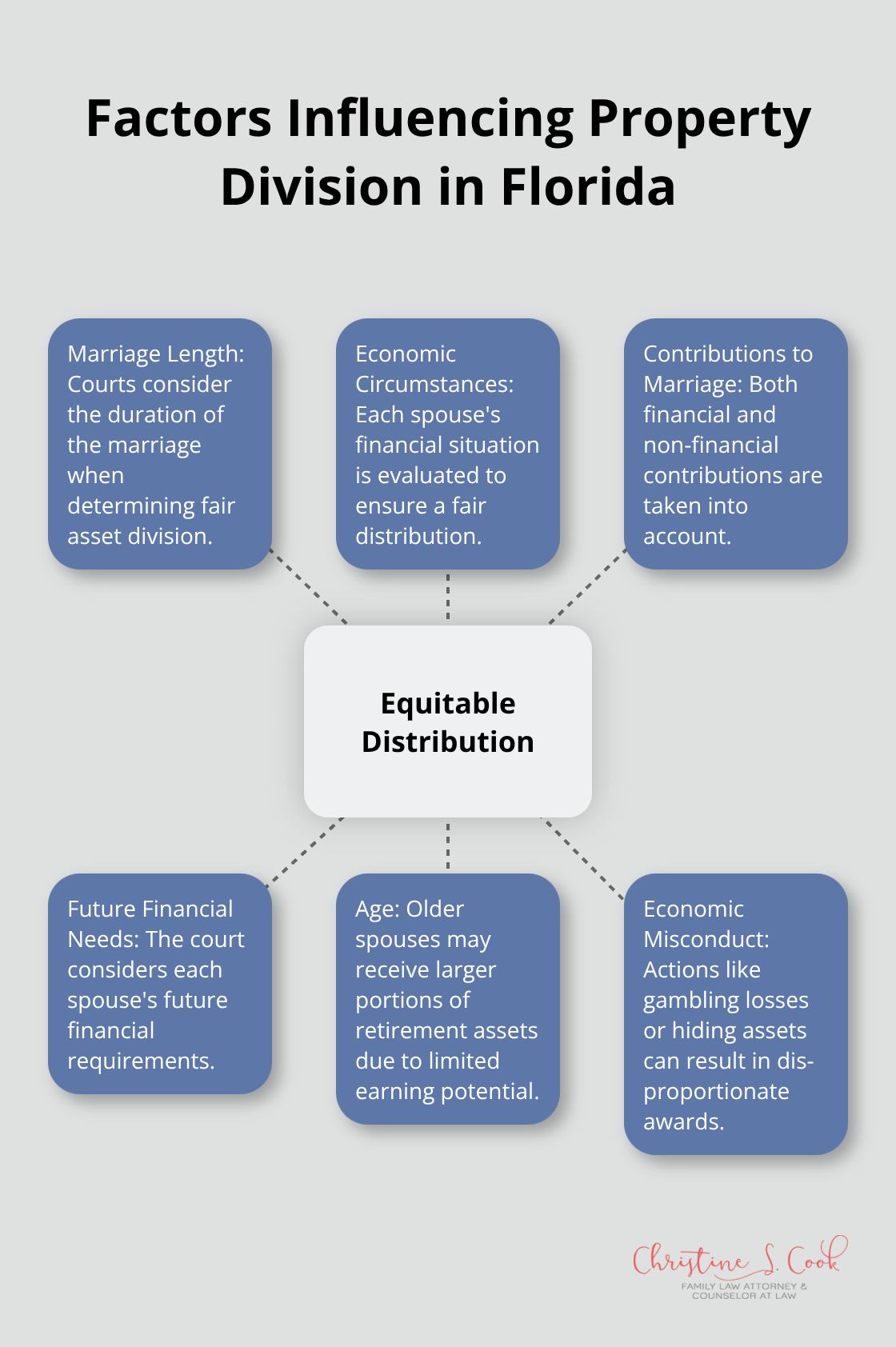

Florida operates under equitable distribution laws, which means courts divide marital property fairly rather than equally. This system gives judges significant discretion in asset division, making Florida fundamentally different from the nine community property states like California and Texas where assets split 50-50. Under Florida Statute 61.075, courts consider multiple factors including marriage length, each spouse’s economic circumstances, contributions to the marriage, and future financial needs. The statute provides guidelines for equitable distribution of marital assets and liabilities in dissolution proceedings.

Florida courts divide all marital property acquired during marriage, regardless of whose name appears on the title. This includes retirement accounts, business interests, real estate appreciation, and even professional licenses that generate income. Separate property like inheritances or pre-marital assets typically remain with the original owner, but Florida courts can distribute separate property under certain circumstances involving long-term marriages or insufficient marital assets for support. The key distinction lies in timing and commingling – any separate asset that becomes mixed with marital funds may lose its separate status entirely.

Courts weigh practical considerations that directly impact your final settlement. Higher-earning spouses often receive smaller asset percentages when they pay substantial alimony, while primary caregivers may receive the family home to maintain children’s stability. Age plays a major role – spouses over 50 frequently receive larger portions of retirement assets due to limited earning potential, particularly for those who sacrificed careers for family. Florida judges also consider economic misconduct, including gambling losses or hidden assets, which can result in disproportionate awards favoring the innocent spouse.

Asset valuation presents unique challenges in Florida divorce cases. Courts require professional appraisals for businesses, real estate, and collectibles to establish fair market value. Retirement accounts need special attention because they often represent the largest marital asset – substantial retirement funds may require a Qualified Domestic Relations Order to divide without tax penalties. Professional practices like medical or legal offices require specialized business valuations that consider goodwill, client relationships, and future earning capacity.

These valuation complexities make proper documentation and expert guidance essential when you create your property division checklist.

An effective property division checklist requires systematic documentation that begins three to six months before you file. Start by collecting five years of tax returns, bank statements, credit card records, and investment account summaries. Financial experts recommend that you gather mortgage statements, insurance policies, and business records for any jointly owned enterprises. Comprehensive financial records help streamline property division processes and ensure proper tax treatment of transfers that occur during divorce. Focus on recent transactions first – any transfers, purchases, or account changes within 12 months of separation require special attention since courts scrutinize these for potential asset concealment.

Professional appraisers charge between $300 and $500 for residential property valuations, but this investment prevents costly disputes later. Take photographs of valuable personal property (jewelry, art, collectibles, and electronics) with serial numbers visible. Bank account balances fluctuate daily, so document all accounts on the same date to create an accurate financial snapshot. Retirement accounts need special attention – request benefit statements directly from plan administrators rather than rely on online summaries that may exclude vesting details or employer contributions.

Florida courts treat any asset acquired during marriage as marital property unless you prove otherwise through clear documentation. Inheritances remain separate property only when kept in individual accounts without any marital funds added. Wedding gifts to both spouses automatically become marital property, while individual gifts from family members stay separate if properly documented. Pre-marital assets that increase in value during marriage create complex situations – the original value remains separate, but appreciation may become marital property that requires professional valuation to split correctly.

Business interests present unique challenges that demand professional expertise. Courts require certified business appraisals for any company ownership, partnership interests, or professional practices acquired during marriage. Stock options and restricted shares need careful evaluation since vesting schedules affect their current value. Real estate appreciation calculations become complex when one spouse contributed separate funds for improvements or mortgage payments (these contributions may create reimbursement claims). Professional licenses and degrees typically don’t qualify as divisible property in Florida, but their enhanced earning capacity influences alimony determinations.

These valuation complexities lead directly to common mistakes that can cost thousands in your final settlement. Working with professionals who understand collaborative law for conflict resolution can help minimize disputes and create more amicable outcomes during this challenging process.

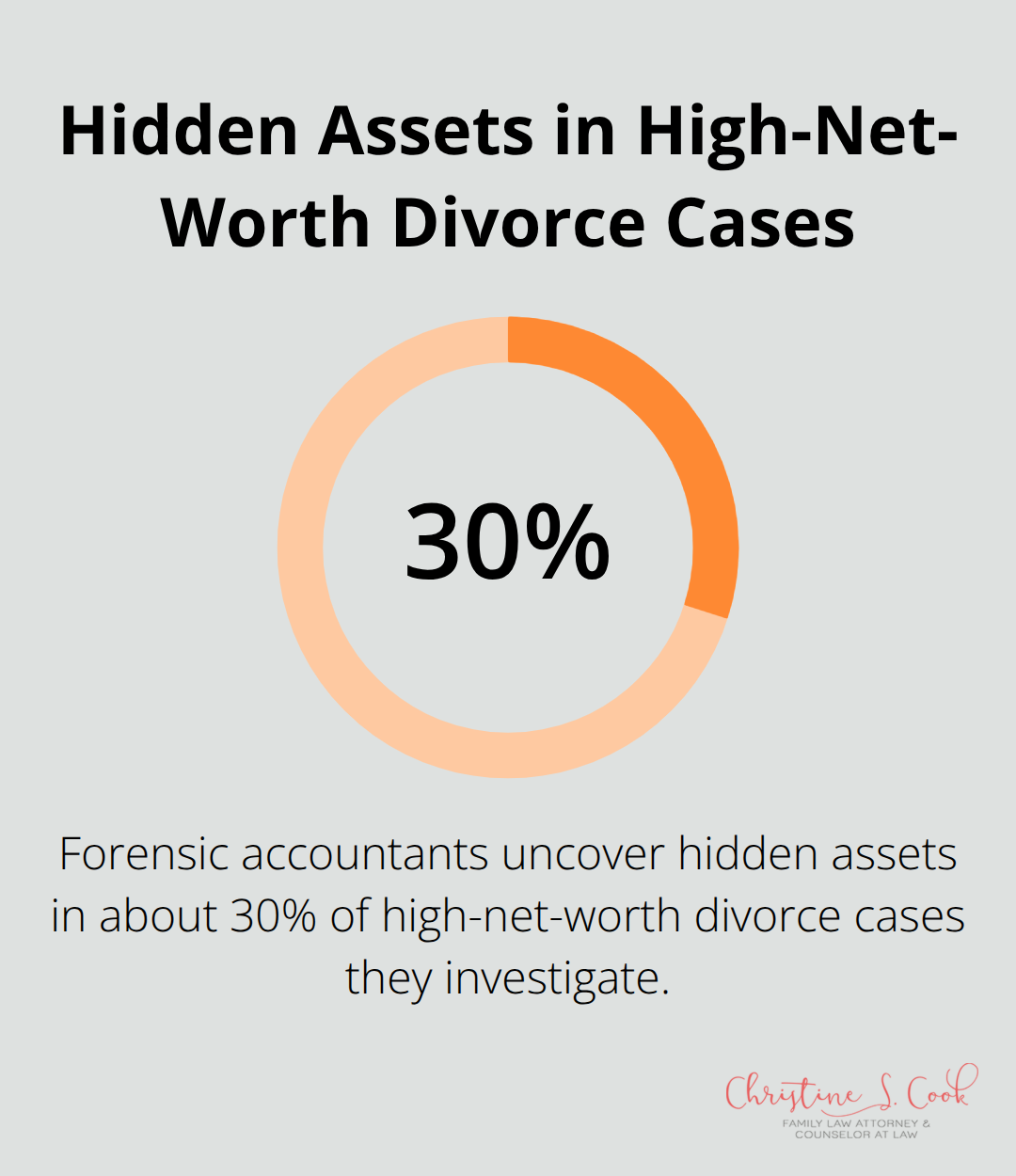

Property division mistakes cost Florida couples thousands of dollars in lost assets and future financial security. These errors occur repeatedly, and most stem from inadequate preparation rather than complex legal issues. The Internal Revenue Service reports that retirement account early withdrawal penalties alone cost Americans over $1.5 billion annually, while forensic accountants find hidden assets in approximately 30% of high-net-worth divorce cases they investigate.

Financial deception occurs more frequently than most people realize, particularly when one spouse controls household finances exclusively. Sudden changes in spending patterns signal potential problems, along with new credit cards that arrive in mail or unexplained cash withdrawals that exceed $500 monthly. Business owners often manipulate income timing when they defer bonuses or delay invoices until after divorce proceedings conclude.

Cryptocurrency investments present new opportunities for asset concealment. Check browser histories for wallet applications, trading platforms, or blockchain explorers that suggest digital asset ownership. Professional forensic accountants charge between $150 and $400 per hour but recover an average of $50,000 in hidden assets per case they investigate.

Property transfers between spouses avoid immediate tax consequences under Internal Revenue Code Section 1041, but future tax obligations transfer with the assets. The spouse who receives the family home inherits the original purchase price basis, which creates substantial capital gains taxes when they sell later. Retirement account distributions before age 59.5 trigger 10% penalties plus ordinary income taxes that can consume 40% of withdrawn funds.

Stock portfolios with embedded gains create different tax burdens. The spouse who receives appreciated securities faces higher future tax bills than the spouse who receives cash equivalents (this difference can amount to tens of thousands in additional taxes).

401k and pension valuations require precise timing since account balances fluctuate daily with market conditions. Many couples use outdated statements or fail to account for employer contributions that vest over time. Pension plans present complex calculations that involve life expectancy, interest rates, and benefit formulas that require actuarial expertise.

Federal employees with Thrift Savings Plans need special attention because their accounts include multiple investment options with different risk profiles and growth potential. Military retirement benefits combine immediate pension payments with future healthcare coverage that adds substantial value (this combination requires professional assessment to value accurately).

Property division requires a complex evaluation of marital and separate property that extends beyond simple equal splits between spouses.

A comprehensive divorce property division checklist protects your financial future and prevents costly oversights during Florida divorce proceedings. Thorough documentation of all marital assets, debts, and financial records forms the foundation for fair property division outcomes. Professional legal guidance becomes essential when you face complex asset valuations, business interests, or substantial retirement accounts.

Hidden assets, tax implications, and retirement account penalties can cost thousands without proper expertise. We at Christine Sue Cook, LLC understand these complexities and provide compassionate legal support through collaborative law techniques and aggressive court representation when necessary. Your divorce property division checklist must include five years of financial records, photographs of valuable personal property, and professional appraisals for real estate and business interests (document everything systematically and maintain detailed records throughout the process).

Christine Sue Cook, LLC offers free consultations to discuss your specific property division needs without financial pressure. Protect your financial future with experienced legal guidance that prioritizes your interests. We work to achieve favorable settlement outcomes that secure your long-term financial stability.