Divorce reshapes your entire financial picture, and your estate plan needs to reflect that reality. At Christine Sue Cook, LLC, we’ve seen too many people overlook this critical step, leaving their assets vulnerable and their wishes unclear.

Your beneficiary designations, trust documents, and guardianship arrangements won’t update themselves after a divorce. The sooner you address estate planning after divorce, the sooner you protect what matters most.

Your will is likely the most important document you own, and it probably still lists your ex-spouse in places that made sense during marriage. In many states, divorce automatically revokes provisions benefiting an ex-spouse in your will, but this protection is far from universal. Some states only revoke spousal provisions, leaving your ex-spouse intact as executor or guardian designations. Others provide no automatic revocation at all. Rather than gamble on your state’s rules, you need to rewrite your will entirely.

Rewriting your will means removing your ex-spouse as a beneficiary, executor, or guardian, and replacing those roles with people you actually trust now. This step matters more than most people realize. If you have minor children, name guardians who reflect your current family situation, not the partnership you had during marriage. Many people delay this step because rewriting a will feels overwhelming, but the cost of a new will is minimal compared to the litigation that erupts when an outdated will contradicts your actual wishes.

Your asset distribution plan likely centered on protecting your spouse’s financial security. That strategy is finished. Instead, think about what your children need, what your parents might require, and what causes or people actually deserve your money after you’re gone. If you had planned to leave 60% of your estate to your spouse and 40% to your children, that ratio probably needs complete reversal.

Document your reasoning for these changes clearly in your will or in a separate letter to your executor. This clarity prevents your children from questioning the distribution or suspecting foul play. If you inherited money during the marriage that you kept separate, verify whether your will properly designates it to your intended heirs. Inherited assets can become tangled in divorce proceedings, and your will needs to clarify exactly how those funds should pass after your death. Consider whether you want assets to pass outright to adult children or through a testamentary trust (which provides structure and protection for beneficiaries).

If you have minor children, your ex-spouse was probably your backup guardian plan during marriage. That arrangement is finished. Name guardians who share your values, live in a location where your children can thrive, and have the capacity to raise your kids if something happens to you. Many people name a sibling, parent, or close friend.

Verify that your chosen guardians actually want this responsibility before naming them. A surprising number of guardianship disputes arise because the named guardian never agreed to serve. If you have children from different relationships, consider whether you want them raised together or separately. Your will should address this explicitly. You should also name an alternate guardian in case your first choice becomes unable to serve. Update this decision every few years as your children grow and family circumstances shift.

Your will now reflects your post-divorce reality, but other documents demand equal attention. Estate planning, trusts, powers of attorney, and healthcare directives all require the same careful review and revision you just completed for your will.

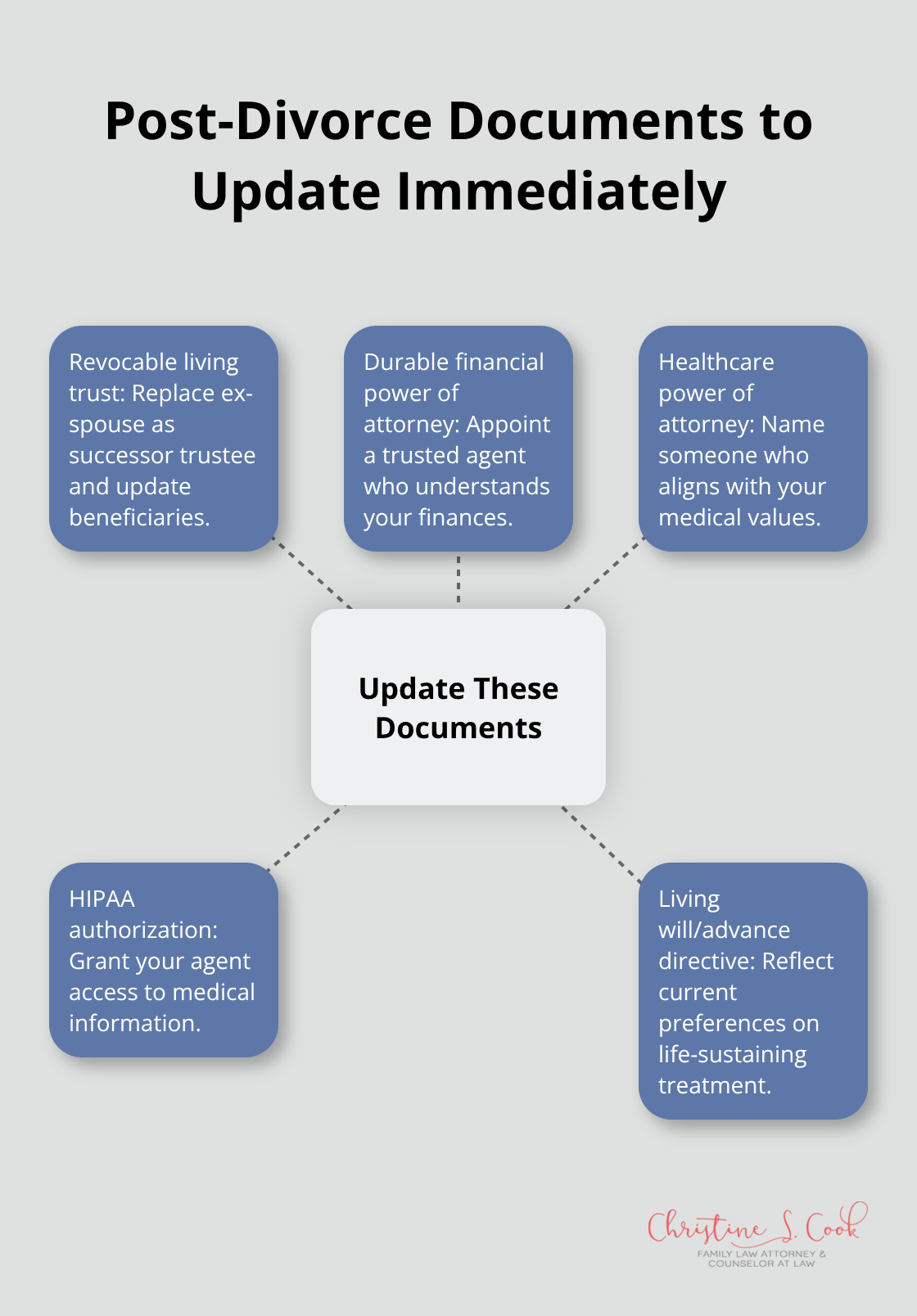

Your trust documents and powers of attorney are just as outdated as your will, and they carry different risks. A revocable living trust that names your ex-spouse as successor trustee means your ex could control your assets if you become incapacitated. A durable power of attorney naming your ex-spouse as your financial agent means your ex could access your bank accounts, sell your property, or make investment decisions without your consent. These documents don’t automatically update after divorce in most states. You must fix them yourself, and the window to act safely is narrow.

If you become unable to make decisions before updating these documents, your ex-spouse could retain authority over your finances and healthcare decisions indefinitely. Start by pulling every trust document, power of attorney, and healthcare directive from your files. Check who is named as successor trustee, financial agent, and healthcare proxy. If your ex-spouse appears in any of these roles, replace that person immediately.

For revocable trusts, you can amend or revoke the document entirely without court involvement, giving you complete control over the revision process. This flexibility makes revocable trusts far superior to irrevocable trusts for post-divorce planning. Irrevocable trusts are harder to change and may require your ex-spouse’s consent or a court order, which complicates everything unnecessarily.

If you established an irrevocable trust during your marriage and your ex-spouse is a beneficiary or trustee, consult an attorney immediately because your options are limited and time-sensitive. The sooner you address irrevocable trust complications, the sooner you regain control of your financial future.

Your financial power of attorney should name someone you trust completely, because this person can access your money and make binding financial decisions. Many people name their ex-spouse during marriage because they were the trusted partner. That logic is finished. Instead, name a sibling, adult child, parent, or close friend who lives nearby and understands your financial situation.

Some people name multiple agents to serve simultaneously or successively, which provides backup protection. Verify that your chosen agent actually understands financial matters and can handle paperwork, because a well-meaning but disorganized agent creates more problems than solutions.

Your healthcare power of attorney and HIPAA authorization should name someone who respects your medical values and can make difficult decisions under pressure. Many people name different agents for financial and healthcare decisions, which is smart because financial competence and medical judgment are completely separate skills.

Update your living will or advance directive to reflect your actual medical preferences now, not the wishes you held during marriage. If you previously wanted aggressive life support because your spouse wanted you to survive at all costs, reconsider that decision in light of your current values. These documents typically take 10 to 20 minutes to complete with an attorney’s help, and they cost far less than the chaos that erupts when outdated documents conflict with your actual wishes during a medical crisis or financial emergency.

Your will, trusts, and powers of attorney now reflect your post-divorce reality. But your beneficiary designations on retirement accounts and insurance policies operate independently from these documents, and they override your will entirely. That’s where your next critical vulnerability lies.

Your will controls most of your estate, but beneficiary designations on retirement accounts, life insurance policies, and certain investment accounts control who receives certain assets and override your will. These designations pass assets directly to whoever you named, regardless of what your will says. If you named your ex-spouse as beneficiary on a 401(k) and your will leaves everything to your children, your ex-spouse receives the funds from that account and your children receive nothing from that account. This outcome happens regularly because people assume divorce automatically removes an ex-spouse from beneficiary designations. It does not. Federal law protects ex-spouse beneficiary designations in some cases, but state law varies widely, and many institutions simply process whatever designation form is on file. You must contact every financial institution and insurance company and request beneficiary changes yourself, in writing, and then verify the changes were actually processed.

Start by listing every account with a beneficiary designation: 401(k)s, IRAs, Roth IRAs, life insurance policies, annuities, health savings accounts, brokerage accounts, and bank accounts. For each account, call the institution and request a current beneficiary designation form. Do not assume you know who is listed. Many people discover their ex-spouse still appears as primary beneficiary on accounts they forgot existed. Once you confirm who is currently listed, decide who should receive each asset.

If you have minor children, consider naming a trust as beneficiary rather than naming the children directly. A trust manages the money until your children reach adulthood and prevents them from receiving a lump sum at age 18. For life insurance specifically, naming a trust as beneficiary also protects the proceeds from creditors and ex-spouses if your children face financial difficulties later.

Submit the new beneficiary designation forms to each institution and request written confirmation that the change was processed. Some institutions allow online changes, but many require a wet signature on a paper form. Do not assume an electronic submission is sufficient. Follow up in writing two to three weeks after submission and request proof that the change appears in their system. Keep copies of every beneficiary designation form and confirmation letter in a file with your estate planning documents.

If you have a pension or military survivor benefits, divorce typically requires a Qualified Domestic Relations Order (QDRO), which is a court order that divides retirement benefits between you and your ex-spouse according to your divorce decree. Your ex-spouse’s rights to your pension do not disappear simply because you updated your will or beneficiary designations. If your divorce decree awards your ex-spouse a percentage of your pension, that person retains those rights regardless of any documents you sign.

However, you must verify whether your ex-spouse still appears as a survivor beneficiary on your pension plan. Some pension plans automatically remove the ex-spouse as survivor beneficiary after divorce, but many require you to submit documentation to the plan administrator. Contact your pension plan administrator or your employer’s human resources department and provide a copy of your divorce decree. Request written confirmation that your ex-spouse has been removed as survivor beneficiary and that you have designated new beneficiaries for any remaining survivor benefits. If you have military service, contact the military branch directly about updating survivor benefit designations, because military survivor benefits follow different rules than civilian pensions.

Your healthcare power of attorney and HIPAA authorization form are not technically beneficiary designations, but they operate in the same category because they control access to your medical information and decisions about your care if you become incapacitated. If your ex-spouse is named as your healthcare power of attorney or HIPAA agent, that person retains authority over your medical decisions and access to your health information unless you revoke the designation in writing.

Update your healthcare power of attorney to name someone you currently trust, and submit a new HIPAA authorization form to your healthcare providers naming your new agent. Request written confirmation from your healthcare providers that they have received and processed the new form. Without this documentation, your providers may still honor the old designation if your ex-spouse appears at the hospital during a medical crisis.

Your estate plan reflects your current wishes, your current family structure, and your current financial reality after divorce. Life will change again-you may remarry, have more children, acquire significant assets, or experience major shifts in your relationships-and your documents must evolve with those changes. Set a calendar reminder to review your estate plan every three to five years, or immediately after any major life event.

The cost of updating your documents is minimal compared to the litigation that erupts when outdated designations contradict your actual wishes. Outdated beneficiary forms and conflicting provisions can cost tens of thousands of dollars and damage your family relationships for years. Your children may spend years fighting over assets you intended to protect them, not divide them.

Gather your documents, list every account with a beneficiary designation, and contact Christine Sue Cook, LLC to review your complete estate planning after divorce situation. We offer free consultations to discuss your specific circumstances without financial pressure, and our team helps you verify that all your documents work together and that your beneficiary designations actually match your wishes.