Divorce proceedings can put your financial future at risk if you don’t take the right steps early. Florida’s equitable distribution laws mean courts will divide marital assets, but you have options to protect what’s rightfully yours.

We at Christine Sue Cook, LLC know that understanding how to protect your assets during a divorce in Florida requires strategic planning and proper legal guidance.

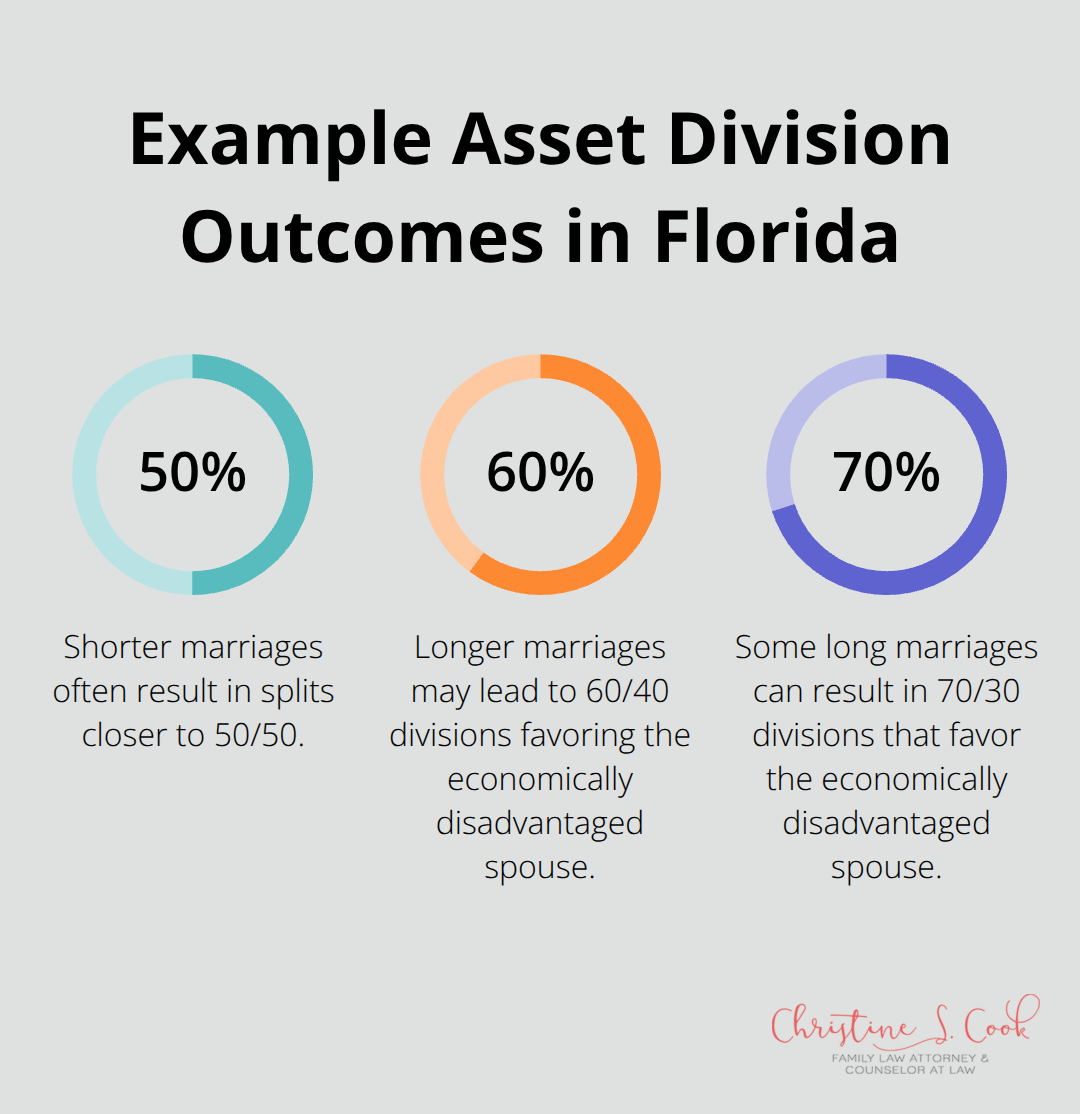

Florida operates under equitable distribution laws outlined in Florida Statutes Chapter 61, which means courts divide marital property fairly but not necessarily equally. The court starts with a presumption of equal distribution, then examines specific factors to determine if an unequal split serves justice better. Marriage duration plays a major role – couples married less than seven years typically see closer to 50/50 splits, while longer marriages may result in 60/40 or 70/30 divisions that favor the economically disadvantaged spouse.

Marital assets include everything you acquire during marriage, from real estate purchases to retirement account contributions. Your separate property consists of assets you owned before marriage, inheritances, and gifts that someone gave specifically to you alone. However, commingling destroys separate property protection. If separate funds were repeatedly deposited into a joint account, the asset may be considered marital property subject to division. Courts require clear documentation that proves separate ownership – bank statements, deeds, and gift letters become your strongest defense.

Florida courts weigh eight specific factors when they divide assets. Each spouse’s economic circumstances carry significant weight – if one partner sacrificed career advancement for homemaking, courts often award them a larger share. Intentional asset dissipation within two years of filing triggers penalties against the wasteful spouse (this includes gambling losses or lavish spending). The court examines contributions to marriage, including non-monetary ones like childcare and household management. Your age, health, and future earning capacity also influence decisions. Courts particularly scrutinize cases that involve business ownership, often requiring professional valuations to determine fair distribution.

Professional appraisers determine the fair market value of real estate, businesses, and collectibles before courts make distribution decisions. Retirement accounts require special handling through Qualified Domestic Relations Orders (QDROs) to ensure your spouse receives their share without triggering tax penalties or early withdrawal fees. Stock options and restricted shares present unique challenges since their value fluctuates and vesting schedules vary. Courts often order forensic accountants to trace hidden assets or investigate claims of separate property enhancement during marriage.

These valuation complexities make proper documentation and strategic planning essential before you file for divorce.

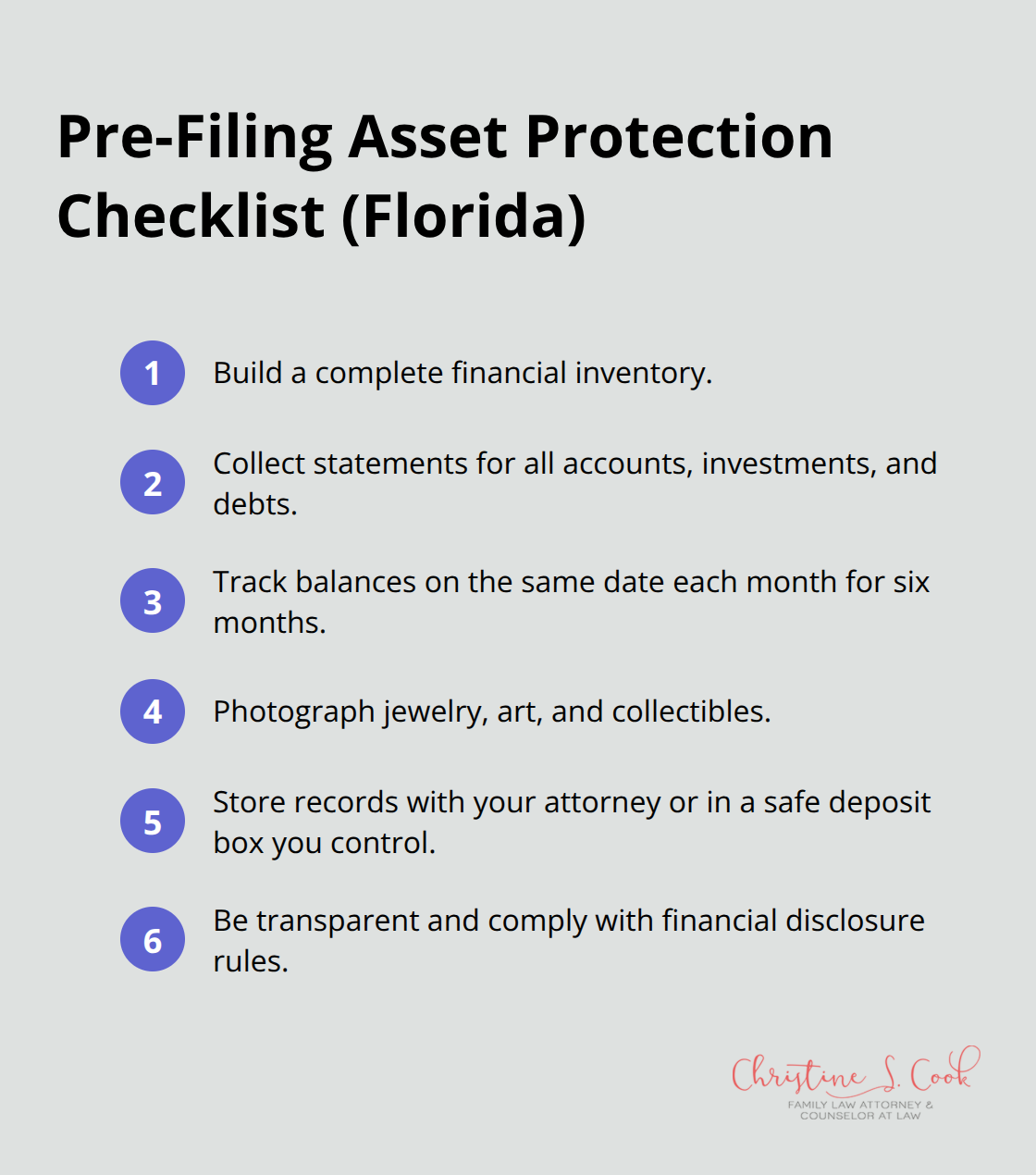

Smart asset protection starts months before you file divorce papers, not during court proceedings. Create a comprehensive financial inventory that includes every bank account, investment portfolio, retirement fund, real estate holding, business interest, and debt obligation. Florida courts require complete financial disclosure, and missing assets can trigger contempt charges or sanctions against you. Document account balances on the same date each month for six months before you file to establish patterns and prevent accusations of hidden assets. Take photographs of valuable personal property like jewelry, art, and collectibles, then store these records with a trusted attorney or in a safety deposit box that only you control.

Your separate property loses protection the moment it mingles with marital funds, and Florida courts show no mercy for sloppy record keeping. Maintain dedicated accounts for inheritances, gifts, and pre-marital assets throughout your entire marriage. Bank statements from before your wedding date prove initial separate property values, while deposit records demonstrate that you never commingled these funds. Title documents, gift letters from family members, and inheritance paperwork become your strongest defense weapons. Historically, marital fault was required for divorce, but now it’s often considered in financial orders, not as a jurisdictional requirement. Open new individual accounts immediately if you currently share access to separate property funds with your spouse.

Collaborative divorce gives you direct control over asset division negotiations instead of surrendering decisions to a judge who knows nothing about your family dynamics. Collaborative Divorce resolves 85% of cases, often within 6 months, while protecting families’ privacy. Both spouses hire specially trained collaborative attorneys who commit to settlement negotiations and cannot represent clients in court if the process fails (this creates powerful incentives for cooperation). Financial neutrals and divorce coaches join the team to provide objective valuations and emotional support throughout the process.

Open individual bank accounts at different financial institutions to establish clear separation between your funds and joint marital assets. Transfer your paychecks to these new accounts while maintaining only necessary contributions to joint household expenses. This strategy protects your earnings from potential claims while demonstrating good faith cooperation with family financial obligations. Courts view this approach favorably because it shows transparency rather than deception (unlike secret offshore accounts or cash hoarding).

Even with perfect preparation, many people make critical mistakes that destroy their asset protection efforts and create legal problems that persist long after their divorce finalizes.

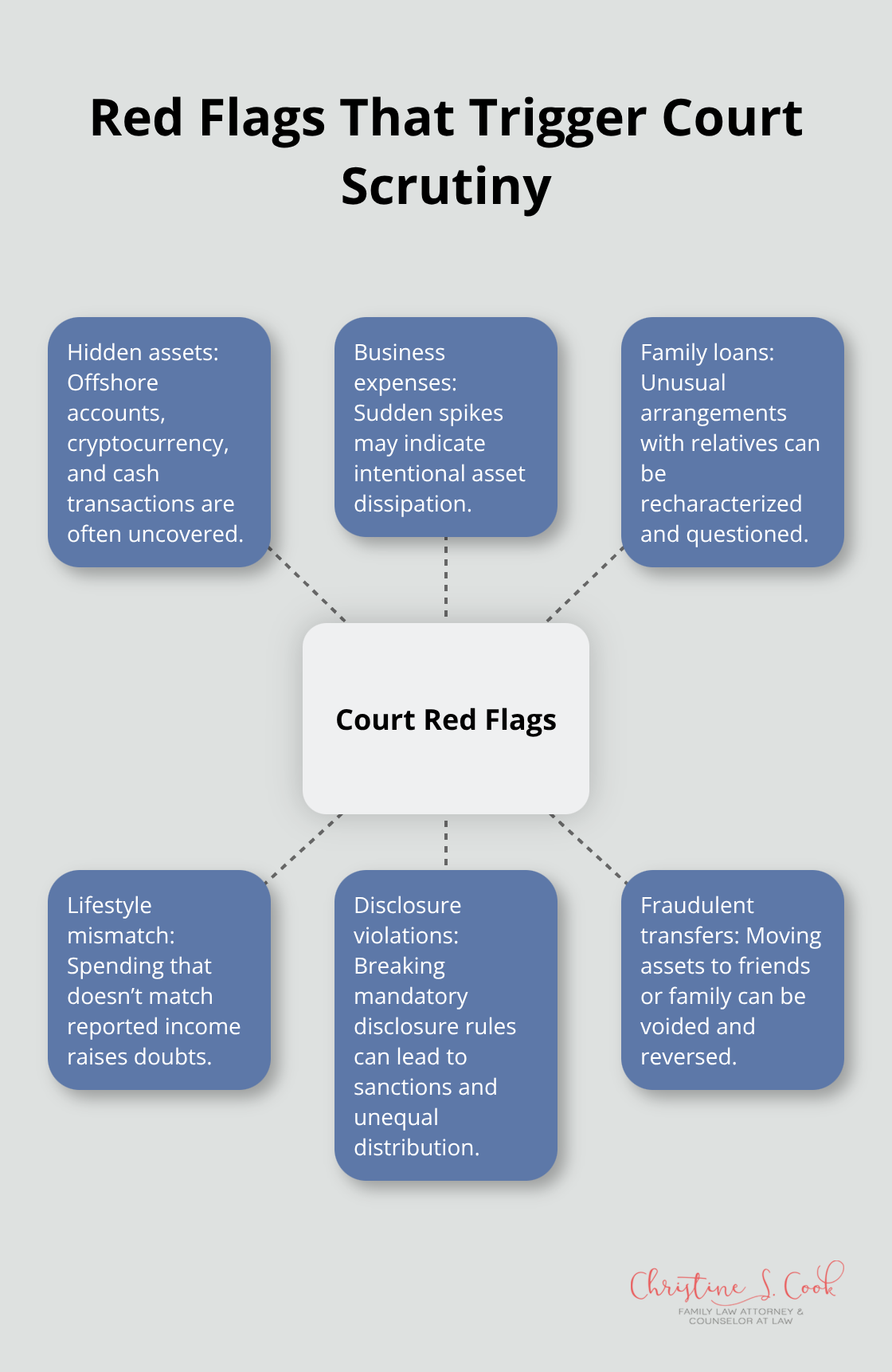

Florida courts impose severe penalties on spouses who attempt deceptive asset protection strategies, and these violations often backfire spectacularly. Courts can impose contempt charges, attorney fee sanctions, and unequal distribution that heavily favors your spouse when you hide assets or violate mandatory disclosure rules under Florida Statute 61.075. Forensic accountants routinely uncover hidden offshore accounts, unreported cryptocurrency assets, and cash transactions that spouses thought they concealed successfully. Courts particularly scrutinize sudden business expense increases, unusual loan arrangements with family members, and lifestyle changes that don’t match reported income levels during the two years before divorce filings.

Asset transfers to friends, family members, or business associates during divorce proceedings violate Florida’s fraudulent transfer laws and trigger automatic reversal of these transactions. Courts can void transfers made within four years of divorce filings if they determine the transfers were designed to defraud creditors or spouses (recipients may face personal liability for asset return plus interest and attorney fees). The Florida Uniform Fraudulent Transfer Act specifically targets transfers made without fair consideration when the transferor becomes insolvent or anticipates future financial obligations.

Courts view luxury cars, expensive vacations, and unnecessary home renovations as intentional asset dissipation that involves unnecessary or extravagant expenditures that do not benefit the marital estate. Judges examine every transaction from the date you file backward through the preceding 24 months to identify wasteful expenditures. Smart spouses maintain existing investment contributions and insurance premiums to avoid claims of asset manipulation, but they avoid new credit lines or substantial purchases without court approval.

Stop all non-essential financial decisions the moment you decide to pursue divorce. Document legitimate business expenses with receipts and contracts to distinguish necessary expenditures from wasteful activities, and never co-mingle personal funds with business accounts during this period (transparency and documentation work better than concealment strategies that create larger problems than the assets they were meant to protect).

Asset protection during divorce requires immediate action and strategic preparation before you file papers. Create detailed financial inventories, maintain separate property documentation, and avoid common mistakes like asset concealment or large purchases during proceedings. Florida’s equitable distribution laws give courts broad discretion, but proper preparation significantly improves your outcomes when you understand how to protect your assets during a divorce in Florida.

Experienced legal counsel makes the difference between safeguarding your financial future and losing assets unnecessarily. We at Christine Sue Cook, LLC provide expert family law services that help clients navigate complex asset protection strategies. Our firm focuses on collaborative approaches while offering strong court representation when negotiations fail.

Early asset protection strategies position you for better outcomes since courts examine financial activities from 24 months before you file. Document everything, maintain transparency, and avoid deceptive practices that trigger penalties (smart preparation today prevents costly mistakes tomorrow). Strategic action now secures your financial stability after divorce concludes.