Divorce often brings financial uncertainties, and one of the most common questions we hear at Christine Sue Cook, LLC is: “Do you have to pay spousal support after divorce?”

The answer isn’t always straightforward. It depends on various factors unique to each couple’s situation.

In this post, we’ll explore the ins and outs of spousal support, helping you understand when it might be required and what alternatives exist.

Spousal support, also known as alimony, refers to financial payments one spouse makes to another after a divorce. At Christine Sue Cook, LLC, we explain that these payments address economic imbalances between former spouses. The primary purpose is to ensure both parties can maintain a reasonable standard of living post-divorce. This support becomes particularly important when one spouse has sacrificed career opportunities for the marriage or family, resulting in a significant income disparity.

The U.S. Census Bureau provides data on the current marital status of persons, by age, sex, and race, as well as the estimated median age at first marriage for men and women. However, specific statistics on alimony payments are not provided in the given source.

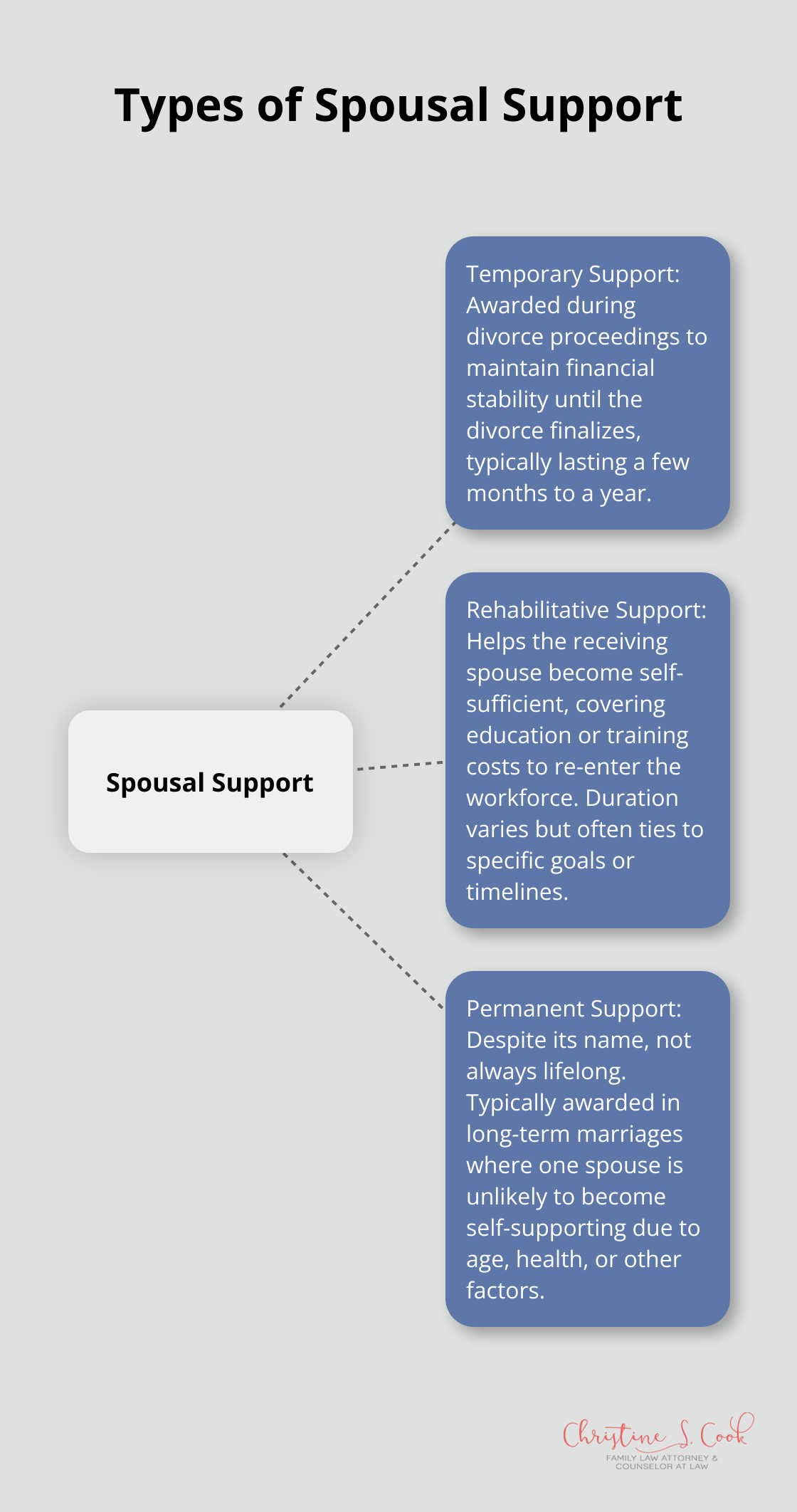

Spousal support comes in three main forms:

Courts consider various elements when deciding on spousal support. These include:

It’s crucial to note that spousal support isn’t gender-specific. While historically more common for husbands to pay wives, either spouse may pay support based on the financial circumstances.

Navigating the complexities of spousal support requires expert legal advice. An experienced family law attorney (like those at Christine Sue Cook, LLC) can guide you through the process, help negotiate fair agreements, and advocate for your interests in court when necessary.

As we move forward, let’s explore the specific factors that determine spousal support in more detail.

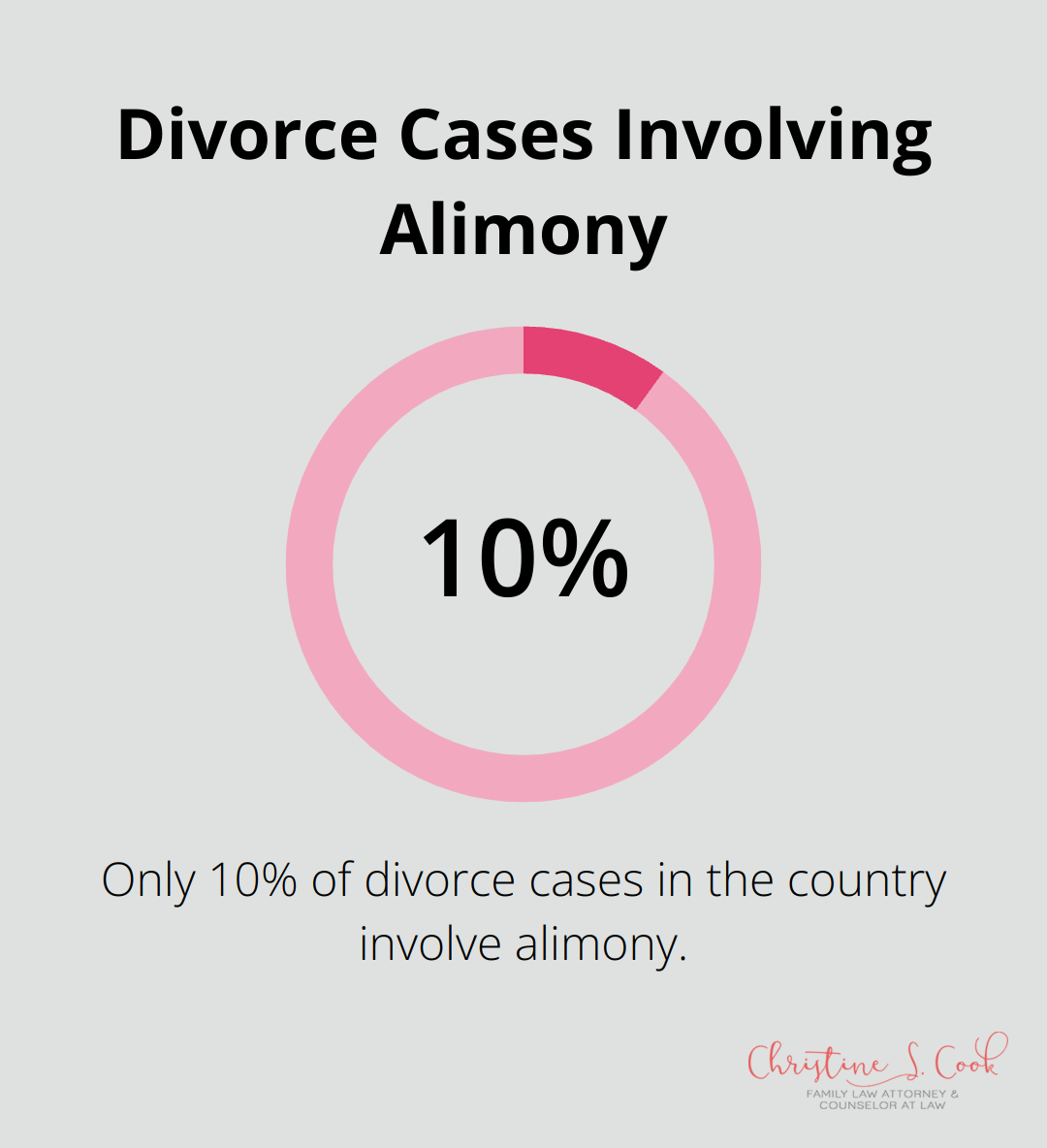

Courts consider the duration of a marriage when deciding on spousal support. Only about 10% of divorce cases in the country involve alimony, highlighting the selective nature of alimony awards.

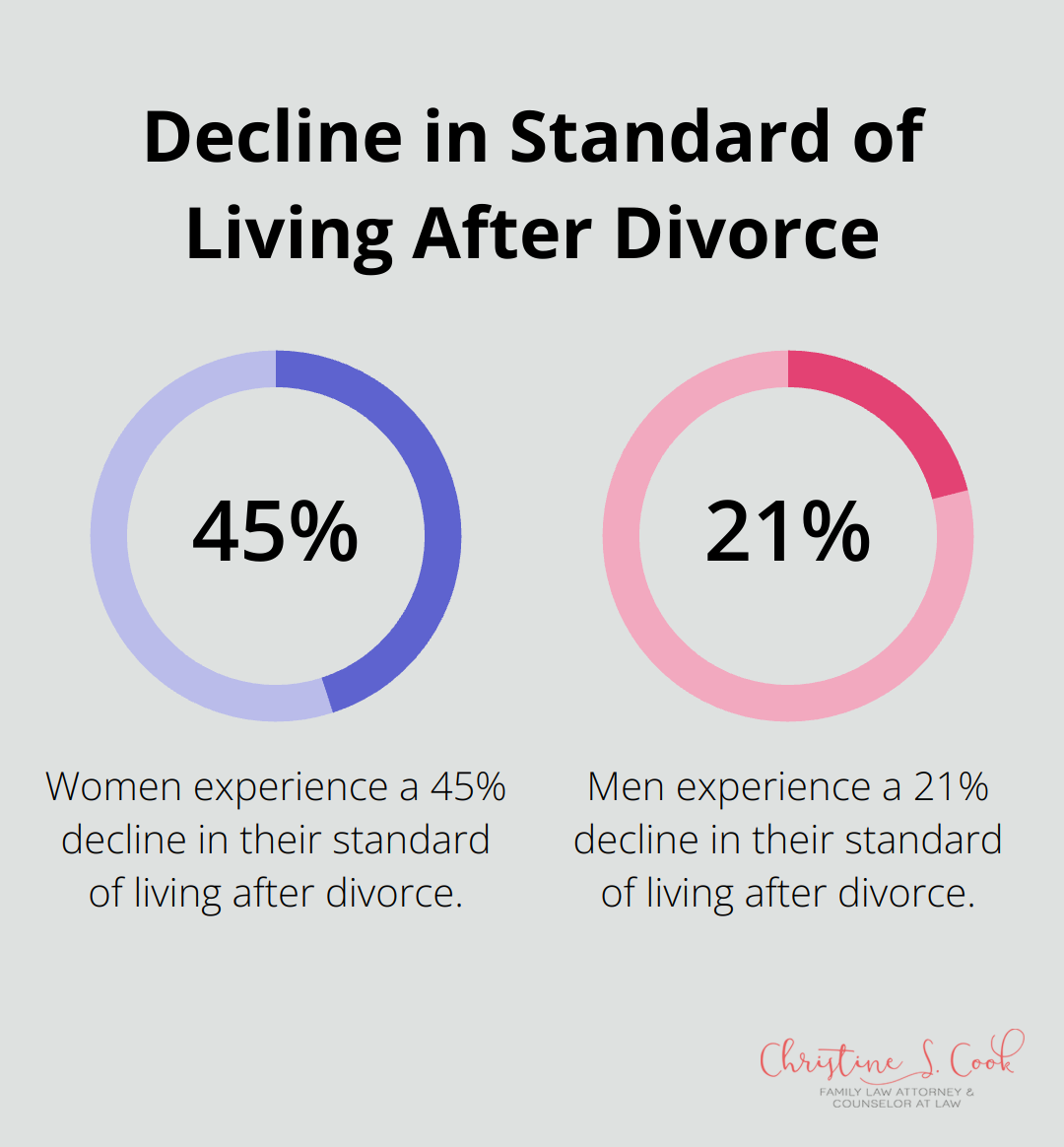

A study revealed that women experienced a 45% decline in their standard of living after divorce, whereas men’s dropped by just 21%. This substantial difference often leads to higher support payments in longer marriages with considerable income disparities.

Courts strive to maintain a similar standard of living for both parties post-divorce. They examine the lifestyle during the marriage, including housing, vacations, and regular expenses. For instance, if one spouse earned $200,000 annually while the other earned $50,000, the court might order support to bridge this gap.

Financial contributions extend beyond income. Courts also consider non-monetary contributions (such as childcare or household management). These factors can significantly influence support decisions, particularly in cases where one spouse sacrificed career advancement for family responsibilities.

The age and health of both parties play a vital role in determining support. Older individuals or those with health issues may receive longer-term support due to limited future earning potential.

A spouse in their 50s with chronic health issues might receive more substantial support than a healthy 30-year-old who can more easily re-enter the workforce. Courts often consider the time needed for education or training to become self-sufficient.

Courts recognize that contributions to a marriage extend beyond monetary aspects. They consider factors such as:

These non-financial contributions can significantly impact spousal support decisions, especially in cases where one spouse forfeited career opportunities to support the family unit.

The tax consequences of spousal support payments can influence the court’s decision. While recent tax law changes have altered the landscape, courts still consider the after-tax impact on both parties when determining support amounts.

Understanding these factors proves essential when approaching divorce proceedings. Whether you’re the potential payor or recipient, knowing how these elements apply to your situation can help you prepare for negotiations or court decisions. As we move forward, let’s explore some alternatives to traditional spousal support that might better suit your unique circumstances.

At Christine Sue Cook, LLC, we understand that traditional spousal support arrangements don’t always fit every situation. We often explore alternative solutions with our clients. These alternatives can offer more flexibility and potentially better outcomes for both parties.

One alternative to monthly spousal support payments is a lump-sum settlement. This approach involves a one-time payment from one spouse to the other, which ends any future financial obligations.

Lump-sum payments can benefit both parties for several reasons. Once the payment is made, there are no ongoing financial obligations to the ex-spouse. This provides immediate financial security for the receiving spouse and eliminates the need for ongoing interactions between ex-spouses.

However, it’s important to carefully calculate the lump sum to ensure it adequately covers future needs. An experienced family law attorney can help determine if this option suits your situation and negotiate a fair amount.

Another approach uses property division as a substitute for ongoing spousal support. This method allocates a larger portion of marital assets to one spouse instead of requiring regular payments.

For example, one spouse might keep the family home or a larger share of retirement accounts in lieu of receiving monthly support. This approach can work particularly well when there are significant assets to divide.

Collaborative divorce has gained popularity as an alternative to traditional litigation. In this process, both parties and their attorneys work together to reach a mutually beneficial agreement, often including creative solutions for financial support.

These agreements might include:

Mediation offers another avenue for determining support arrangements outside of court. A neutral third party helps couples negotiate terms that work for both parties. This process can lead to more creative and flexible support solutions.

Mediation often proves a cost-effective and less adversarial approach to resolving support issues. It allows couples to maintain control over the outcome and often results in more satisfactory arrangements for both parties.

When you consider alternatives to traditional spousal support, it’s essential to work with an experienced family law attorney who can guide you through the pros and cons of each option. These alternatives can offer more flexibility and potentially better outcomes, but they require careful consideration and expert legal advice to ensure they meet your long-term needs.

Spousal support after divorce involves complex decisions. Courts consider factors such as marriage length, income disparity, and non-financial contributions when determining if you have to pay spousal support after divorce. Alternatives like lump-sum payments and property division can offer more flexible solutions for both parties.

Expert legal advice proves essential in navigating spousal support laws. An experienced family law attorney can explain your rights, obligations, and advocate for your best interests. They can guide you through the process and help you understand the potential impact on your financial future.

At Christine S. Cook, LLC, we specialize in family law matters, including spousal support cases. Our team offers compassionate and innovative solutions tailored to your unique situation. We provide free consultations to discuss your legal needs without financial pressure.