Financial disclosure forms the foundation of any successful collaborative divorce process. When both parties share complete financial information openly, it creates trust and leads to fair settlements.

We at Christine Sue Cook, LLC have seen how proper financial transparency can transform what could be a contentious process into a cooperative one. The right approach to organizing and presenting your financial information makes all the difference in reaching agreements that work for everyone involved.

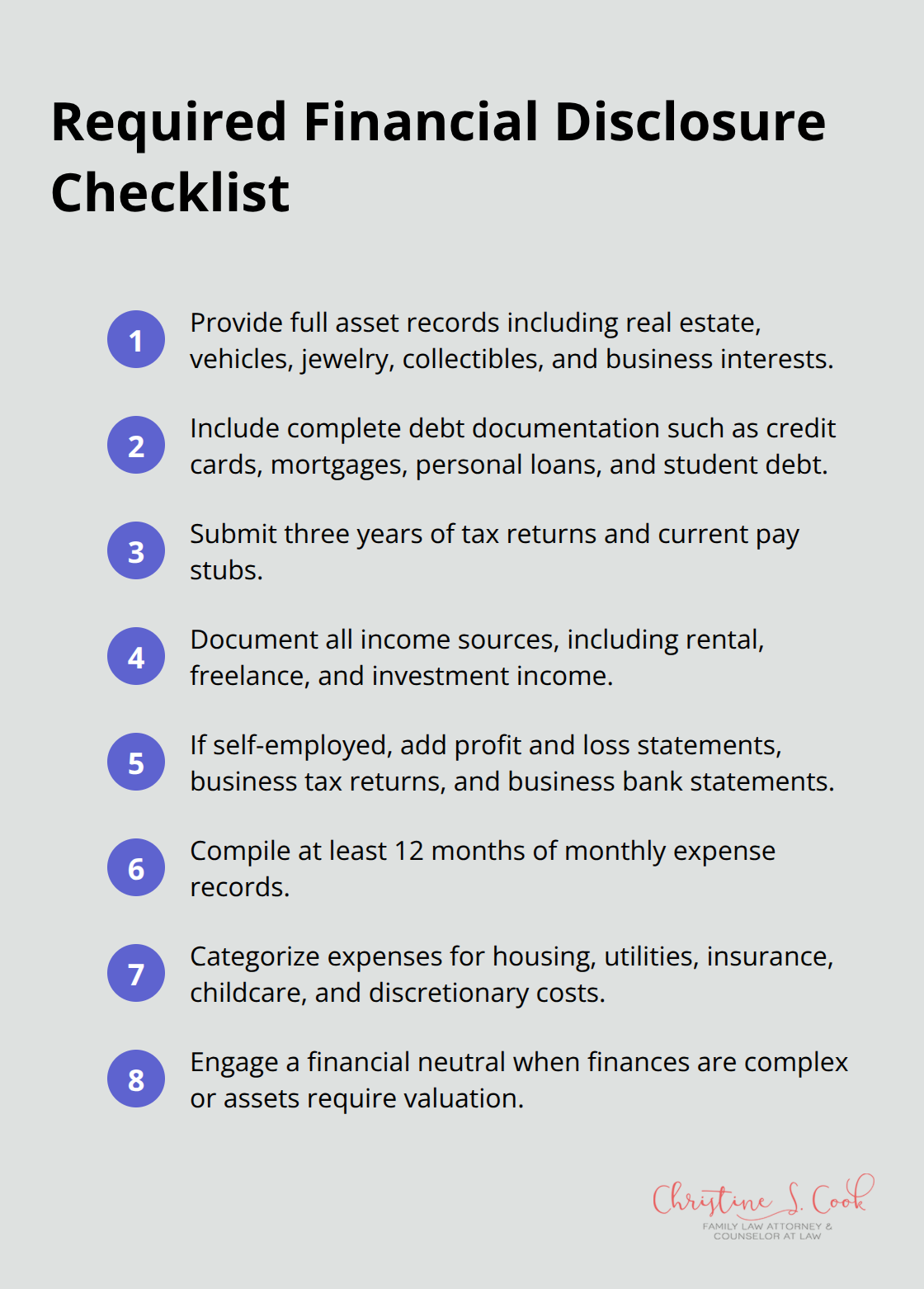

Collaborative divorce demands comprehensive financial documentation that extends far beyond basic bank statements. You must provide complete records of all assets, which include real estate properties, vehicles, jewelry, collectibles, and business interests. Your debt documentation should cover credit card statements, mortgage details, personal loans, and student debt.

California law mandates complete transparency in divorce proceedings, which makes this step non-negotiable for legal compliance.

Your income disclosure must include three years of tax returns, current pay stubs, and documentation of all income sources (rental properties, freelance work, and investment returns). Self-employed individuals need profit and loss statements, business tax returns, and bank statements for business accounts. The collaborative process requires monthly expense records for at least 12 months, which cover housing costs, utilities, insurance, childcare, and discretionary expenses. This detailed expense analysis helps determine realistic spousal support calculations and post-divorce budgets.

Retirement accounts require statements for 401k plans, IRAs, pension funds, and stock option plans. Investment portfolios need current market valuations for stocks, bonds, mutual funds, and alternative investments like cryptocurrency. Business interests demand professional appraisals, especially for partnerships or sole proprietorships. Financial neutrals are ideal when finances are complex, income varies, assets need valuation, or retirement accounts must be divided, which streamlines the disclosure process compared to traditional litigation discovery methods.

The collaborative approach allows targeted information collection rather than extensive searches, which reduces costs while it maintains thoroughness. You should organize documents chronologically and create digital copies for easy access during team meetings. Financial professionals can help you identify gaps in your documentation before formal disclosure begins (preventing delays and additional costs). This systematic approach sets the stage for effective collaboration with your financial neutral and legal team.

Start with bank statements, tax returns, and pay stubs from the past three years. Add investment account statements, retirement fund documents, and property deeds. Include credit card statements, loan agreements, and monthly expense records. Organized documentation helps structure the collaborative divorce process and establishes clear obligations for all parties involved.

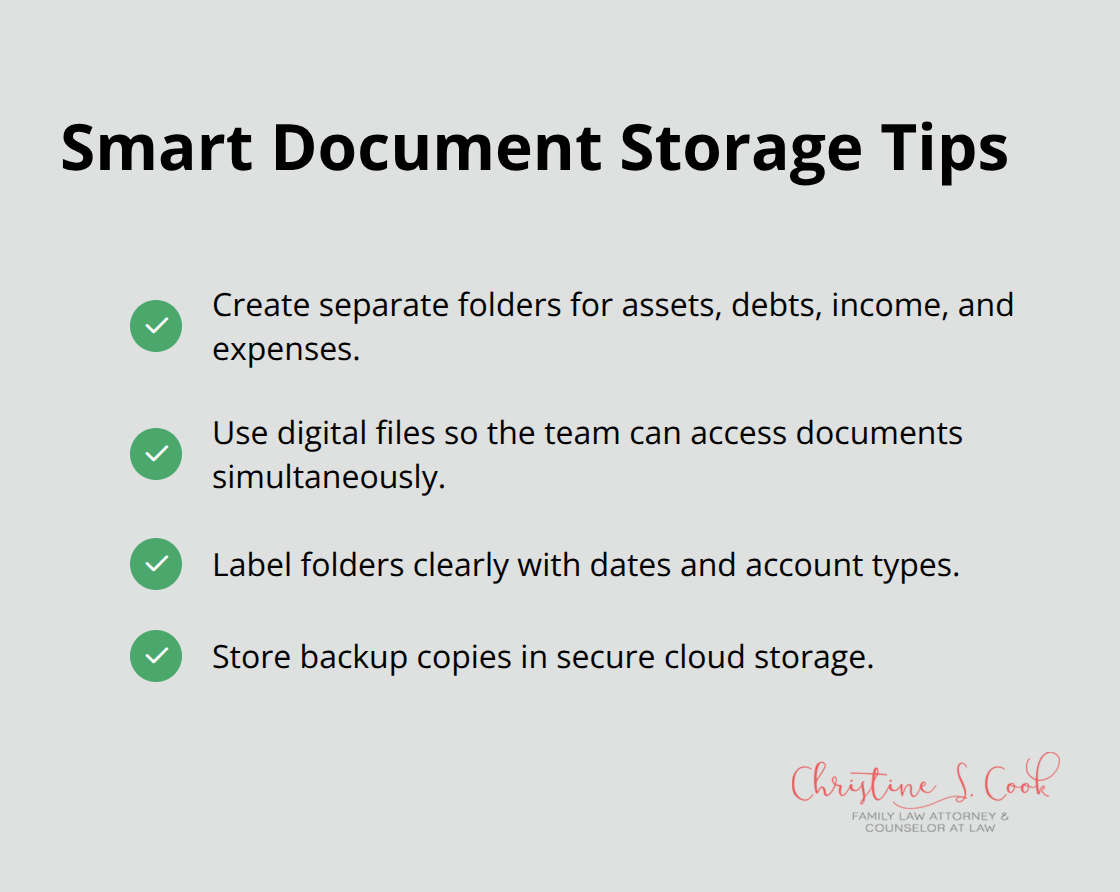

Create separate folders for assets, debts, income sources, and monthly expenses. Digital files work better than paper because team members can access documents simultaneously during meetings. Label each folder clearly with dates and account types. Store backup copies in cloud storage to prevent loss of important financial data.

Follow this sequence: personal financial records first, then business documents if applicable, followed by joint accounts and shared assets. Mortgage statements need three years of payment history. Investment accounts require current values plus transaction histories. Self-employed individuals must gather business bank statements, profit and loss reports, and accounts receivable documentation. Complete documentation helps prevent disclosure delays that typically occur when financial records are incomplete or missing.

Financial neutrals streamline asset valuation and create comprehensive spreadsheets that both parties can understand. These professionals cost significantly less than separate financial experts for each spouse (often saving thousands in duplicate fees). Appraisers become necessary for real estate, business interests, and valuable personal property like art or collectibles. Your collaborative attorney coordinates document sharing between team members, which eliminates duplicate requests and reduces overall costs. A property division worksheet helps track all assets and debts systematically.

This systematic approach to financial organization sets the foundation for addressing the complex challenges that often arise during the collaborative divorce process.

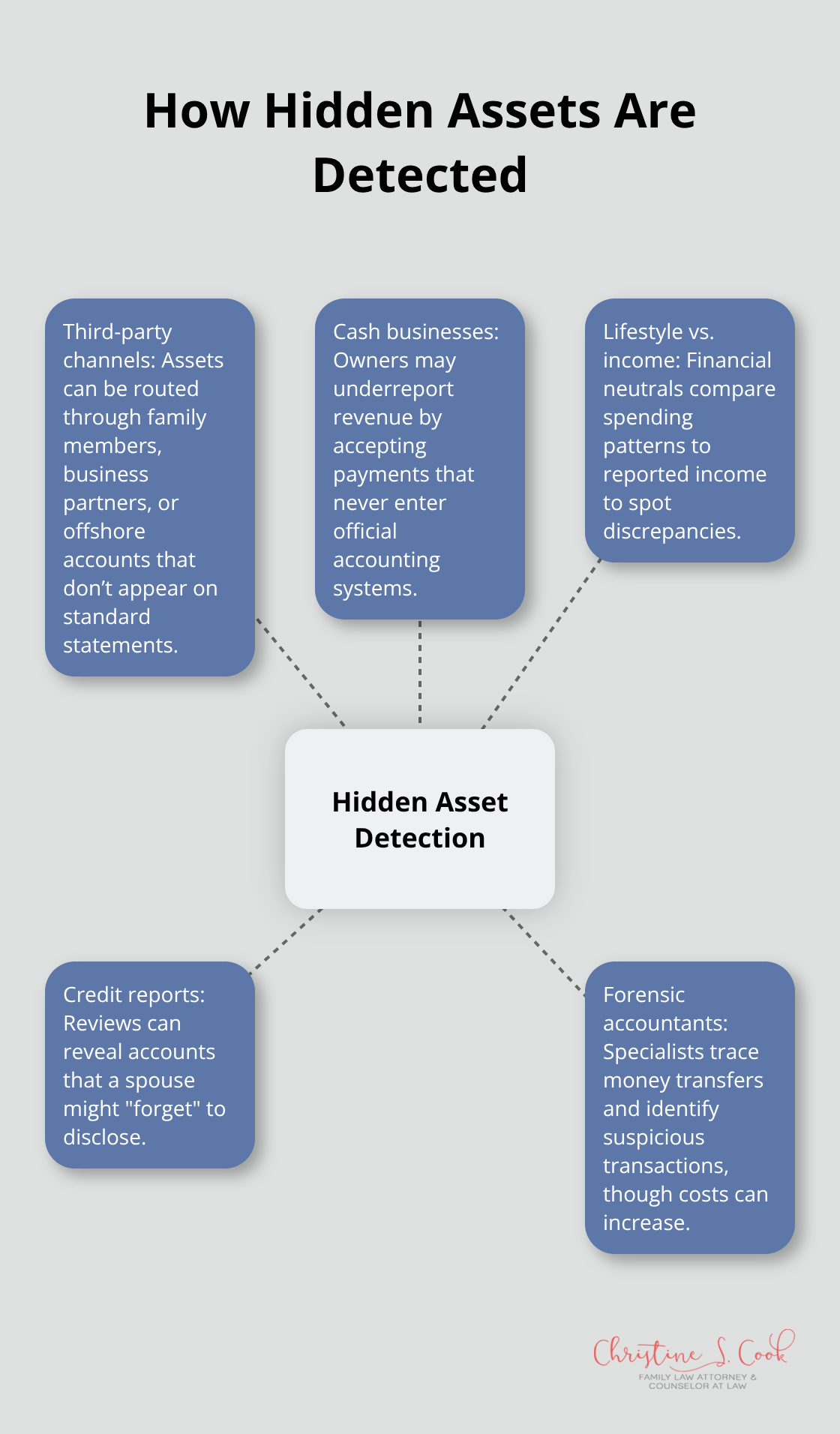

Hidden assets present the most serious threat to fair collaborative divorce settlements. Cryptocurrency accounts, offshore investments, and cash businesses create opportunities for concealment that traditional discovery methods often miss. Financial neutrals identify inconsistencies between reported income and lifestyle expenses, which typically reveal undisclosed assets. Business owners sometimes underreport income when they inflate expenses or delay invoices until after divorce proceedings conclude. The collaborative process requires both parties to sign agreements that mandate complete disclosure, and failure to comply results in automatic attorney withdrawal from the case.

Spouses often hide assets through family members, business partners, or offshore accounts that don’t appear on standard financial statements. Cash-intensive businesses allow owners to underreport revenue by accepting payments that never enter official accounting systems. Financial neutrals examine spending patterns against reported income to spot discrepancies that suggest hidden wealth.

Credit reports reveal accounts that spouses might “forget” to disclose during the process. Professional forensic accountants can trace money transfers and identify suspicious transactions (though this adds significant costs to the collaborative process).

Professional business appraisals are necessary to help divorcing couples and courts reach decisions about equitable division of assets. Stock options require careful analysis because vesting schedules affect current versus future value calculations. Retirement accounts need qualified domestic relations orders for division, and pension benefits require actuarial calculations to determine present value. Real estate appraisals should account for market conditions and recent comparable sales within the neighborhood. Financial neutrals coordinate these valuations efficiently and prevent duplicate appraisals that waste money.

Financial disclosure often triggers anger, fear, or betrayal when spouses learn about undisclosed spending or debt accumulation. Divorce coaches help parties process these emotions constructively rather than allow them to derail negotiations. Specific meeting agendas prevent emotional discussions from overwhelming financial analysis sessions. The collaborative team addresses emotional reactions immediately when they arise, which prevents small issues from becoming major obstacles. Transparent communication about financial concerns helps both parties understand the complete picture and work toward solutions that address underlying fears about post-divorce financial security.

Transparent financial disclosure transforms collaborative divorce from a potentially adversarial process into a cooperative partnership. When both parties share complete financial information openly, settlements become more equitable and disputes decrease significantly. Research shows couples who engage in collaborative divorce report higher satisfaction levels than those who proceed through traditional litigation.

Proper financial disclosure during the process leads to better long-term outcomes for both parties. Complete documentation prevents future conflicts when undisclosed assets surface later. Financial neutrals help create comprehensive asset spreadsheets that both spouses understand (which reduces confusion and builds trust throughout negotiations).

The collaborative approach typically finalizes divorces in six months or less, compared to nine to twelve months for litigated cases. This efficiency saves thousands in legal fees while it preserves privacy through confidential proceedings rather than public court records. We at Christine Sue Cook, LLC provide compassionate legal support that helps clients navigate complex financial disclosure requirements while we protect their interests and future financial security.